- Home

- Carat Tax - Q&A ENG

Carat Tax - Q&A ENG

Below you can find the answers to all of your questions regarding the Carat Tax.

Q1: To which diamond traders does the Diamond Regime apply?

The Diamond Regime (or Carat Tax) applies to all licensed diamond traders (registered with the FPS Economy, License service), both companies and natural persons, who trade in rough or polished diamonds who maintain their own diamond stock for that purpose.

In other words, the application of the Diamond Regime assumes that an licensed trader sells diamonds from his own stock, because it is only then that difficulties arise with regard to a tax audit (for more information, see the section on brokers).

In this regard, the duration of the diamond trader’s legal ownership of the stock is not relevant. A sale shortly after a purchase, even in the event of a so-called ‘flash title’ sale transaction, also triggers the application of the Diamond Regime as turnover is realized from the sale of diamonds for their own account, in that case as well. Indeed, said buy-sell transaction will typically result in the recognition for statutory accounting purposes of resp. “turnover” (i.e. equal to the sum of the sales invoices) as well as “costs of goods sold”. Consequently, the date mentioned on the purchase invoice is in itself irrelevant for assessing the application of the Diamond Regime.

The application of the Diamond Regime for a specific taxable period also assumes that the trader has traded throughout the duration of that period and has, therefore, realized some qualifying “revenue (or turnover) from diamond trading”. If, in a specific year, the trader has not carried out any transactions at all, then the general rules applicable in the Belgian personal income tax or corporate income tax regime will come into play.

The above viewpoint has in the meantime been explicitly confirmed by the Belgian Minister of Finance in his response to the parliamentary question nr. 17013 of Mr. Van de Velde. More in particular, the Minister of Finance stated that:

“If a registered diamond trader is inactive for a year, he has a turnover of €0. In such a case, no turnover has been realized from diamond trading during said taxable period. Since the relevant legal provisions aim to establish the net income that is taxable in case of turnover stemming from diamond trading, the lack of turnover will result in the non- applicability of the Diamond Regime with regard to the taxable period concerned.

In such a case, the “cost of diamonds sold” for the taxable period concerned will not be replaced with the “2,1% on turnover”, no amount of minimum net taxable income will be determined, and no disallowed item will be added to this net result to the extent the minimum directorship remuneration has not been respected. After all, the aforesaid additional disallowed item only takes place in case the net taxable result has effectively been established with the application of the Diamond Regime.”

Q2: Is the application of the Diamond Regime mandatory ?

Yes, all registered diamond traders are subject to the application of the Diamond Regime for all their “genuine and habitual” sale transactions selling out of their own diamond stock and for their own account.

If a diamond trader would denounce its registration as diamond trader , the Diamond Regime will apply up and until the last sales transaction that has occurred prior to said cancellation. In this regard, it should be noted that, hypothetically speaking, the removal from the list of registered diamond traders can only become effective after that final sales transaction took place since the formal registration as diamond trader is in fact part of the regulatory framework of selling diamonds.

The Diamond Regime is only optional for the sales entities of diamond mining companies which are member of a group of companies that operate kimberlite diamond mining or extract alluvial diamonds. By default, these entities are excluded from the application of the Diamond Regime because they do not display any or fewer of the specific characteristics that lead to the aforesaid tax inspection difficulties. However, they can ‘opt-in’ voluntarily to the Diamond Regime.

The voluntary opt-in is valid for a minimum period of three consecutive tax years. The deliberate choice to apply the Diamond Regime needs to be communicated by the aforesaid sales entities when submitting their annual income tax return package for the first tax year during which the regime is to be applied.

Q3: Is it possible to include a de minimis rule keeping in mind so-called “sideline activities”, for example, a diamond company that has sold (or kept in stock) a single diamond and,thus, ideally would not fall under the application of the Diamond Regime?

No, even a single sale of a diamond by a registered diamond trader out of his own stock and for his own account is to be considered as qualifying turnover stemming from diamond trading and, therefore, triggers the application of the Diamond Regime.

Q4: Are the Belgian tax authorities allowed to refuse the application of the Diamond Regime for a registered diamond trader ?

The Diamond Regime is applicable by law to every registered diamond trader selling out of his own stock and for his own account.

However, if, and only if, the Belgian tax authorities are able to evidence that income is realized from transactions other than “genuine and habitual trades”, the Diamond Regime cannot be applied and the net taxable income realized is fully taxed in a regular manner. It is assumed that this specific anti-abuse provision as prescribed by the Diamond Regime will only come into play in very exceptional instances, i.e. when there are indications to suspect that it concerns activities of a “pseudo” diamond trader operating as a front for money laundering or other illegal activities (see infra Q23).

Q5: Does the Diamond Regime apply to brokers and agents for the commercial transactions for which they act as intermediaries?

No.

The Diamond Regime only applies to diamond traders selling diamonds from their own stock and for their own account. This is explicitly confirmed in the explanatory memorandum of the Law of August 10, 2015: “Its application is strictly limited to this group and is, for example, not applicable to diamond brokers for whom the diamond stock difficulties do not present itself” (cf. Parl. Documents, Belgian Chamber of Representatives, Doc. 54, 1125/001, p. 71).

In other words, the Diamond Regime only applies to traders who sell diamonds “in their own name and for their own account”, and who, as compensation, realize the sales price of the diamonds as turnover. As formulated above, if a diamond trader acquires legal title to the goods (irrespective of the duration of this legal ownership),the sales transaction of the diamonds is conducted by the trader for its own account and said transaction is expressed as such in the financial accounts (the sale transaction results in the realization of income which is recorded as turnover), then the Diamond Regime will be applicable (see also Q1).

A “broker”, on the other hand, is a go-between who sells diamonds for the account of a third party-principal and, therefore, only charges/receives a commission fee and does not, himself, realize or record any turnover from diamond trading. A “broker” sells the goods owned by the third party-principal; principally speaking he does not acquire legal title to the goods and is, therefore, legally speaking not considered to be in the flow of goods. Worded differently, the legal ownership of the goods passes directly from the third party-principal to the final purchaser(s). The “broker”, therefore, does not realize a sales margin on the purchase and sale, but he will only be taxed on the commission he earns, which constitutes a compensation for the services he did provide as trade intermediary. Therefore, the Diamond Regime is clearly not applicable to such a “broker”.

In highly exceptional cases, however, a “broker” can also acquire legal title to the goods he sells. In such a case, the “broker” sells the goods that he initially disposed of in consignment, but very shortly before on-selling these he also became the legal owner hereof. Irrespective, it can be clearly evidenced from the facts and circumstances as well as from the underlying intention of the parties concerned that the “broker” continued selling for the account of a third party-principal (i.e. the “broker” did not bear any real risks). Also in this highly exceptional case, one does not need to record for statutory accounting purposes any sales turnover, but merely a commission fee. This viewpoint has recently been confirmed by the Belgian Commission for Accounting Standards. Given the aforesaid, it is clear that the Diamond Regime is equally not applicable to such a “broker”.

Legally speaking, two techniques are principally applied in practice:

- The sales agent, who sells in the name of and for the account of the third party- principal. The identity of the actual seller is known by the buyer. The sales invoice features the direct coordinates of the actual seller/third party-principal, who remained up and until the sale was concluded the legal owner of the goods.

- The trade intermediary who sells for the account of the third party-principal but in his own name, acts as a commissionaire from a legal perspective. The sales invoice features the identity of the commissionaire. The business rationale behind this technique is often to keep the identity of the seller/third party-principal confidential for commercial reasons hereby safeguarding the position of the broker as regards future sales transactions (see also infra).

If a trade intermediary acts as described above, then no “turnover stemming from diamond trading” will be realized. The reasons hereto are twofold:

- Legally: the legal ownership transfers directly from the third party-principal to the buyer, and does not pass through the sales agent or the commissionaire. Worded differently, through an invoice in his own name, the commissionaire does in fact sell goods belonging to a third party-principal, to which the legal ownership is then directly transferred from this third party-principal to the buyer.

- Accounting-wise: the commission received is basically the “turnover” and, logically, no “cost of goods sold” is incurred. On this basis, the Diamond Regime technically cannot be applied.

As mentioned above, in practice it often occurs that diamond “brokers” hold diamond stock from a third party-principal, which they sell for the account of said principal. This particular situation, which is rather common in the diamond trade sector, occurs in concrete terms when the identity of the third party-principal is kept confidential or when the third party-principal prefers to remain anonymous (“undisclosed principal”) vis-à-vis the buyers. Very often, the “broker” first concludes a sales agreement with the purchaser. Subsequently, he receives a purchase invoice from the third party-principal and shortly afterwards the broker provides the buyer with a sales invoice in his own name for the same price, albeit increased with his commission fee.

If the broker can clearly demonstrate that he is acting for the account of the third party- principal – and not for his own account – then the broker is not trading out of his own diamond inventory and, hence, the Diamond Regime does not apply in such a case. This is amongst others the case if the sales price of the diamonds is not recorded in the accounts of the broker as turnover realized, but only the received commission or broker’s fee. In such a case, nearly always a commissionaire agreement will exist between the broker and the third party-principal clearly evidencing that the broker shall indeed sell the goods in his own name and unaltered but for the account of the third party-principal (“undisclosed principal”). Very often (but not always) the broker’s sales invoice will include as a specific reference “diamonds invoiced on behalf of undisclosed principal”.

Another important indication that the trade intermediary is merely acting as a broker (i.e. trading in his own name but for the account of a third party-principal) is in fact the proportion of his commission fee he receives for the commercial services rendered. Evidently, a broker’s compensation should be substantially lower than the profit realized by an actual diamond trader (who takes legal title to the goods and effectively bears a real inventory risk, a market risk, a bad debt risk, etc.).

For completeness sake, we reiterate that if a diamond trader purchases diamonds, records these for accounting purposes as inventory and subsequently on-sells the goods a short time afterwards, then this principally consists of a sale out of one’s own diamond inventory for his own account. Consequently, the Diamond Regime will be applicable. The Diamond Regime does not require a diamond inventory at the end of the taxable period. It is however necessary, but sufficient to “sell out of one’s own diamond inventory for his own account”.

On the other hand, when a diamond trader purchases diamonds from various suppliers, and later on-sells, for example, a mixed parcel thereof to (an)other purchaser(s), this would typically indicate that these diamonds have been considered as being part of one’s own inventory. The re-sorting of various diamond parcels clearly indicates that one is conducting his “own” business activity (and not per se an activity performed for the account of a third party-principal). After all, as a general rule, a trade intermediary will typically offer for sale exactly the same goods as were offered to him to be sold in the first place. Mixing or re- sorting diamond parcels in order to on-sell these in different parcels implies that, with regard to this specific transaction, one probably needs to considered as a true diamond trader (and not as merely a trade intermediary or broker).

Finally, the mere fact that diamond inventory is physically put at the disposal of the broker albeit as inventory on consignment, does not in itself modify the analysis from a legal, accounting and/or income tax perspective.

As regards the sales transactions realized through a trade intermediary the Diamond Regime typically will not apply. However, it could well be that the Diamond Regime will apply to the third party-principal (to the extent he is subject to the Belgian income tax regime and is registered as diamond trader within Belgium), instead of the broker.

The Explanatory memorandum was drafted with the aim to clarify the above distinction.

Q6: How would the Diamond Regime be applied in case of partnerships ?

In this context, a “partnership” is entered into when two or more persons, based on a written agreement or not, jointly purchase diamonds for the purpose of on-selling these hereby realizing a profit (or sharing a loss). Worded differently, a partnership assumes the intention of the parties concerned to realize a long-term project together and, therefore, legally speaking goes beyond a mere joint ownership.

Before one can assess the potential application of the Diamond Regime in a specific case, in first instance it is required to ascertain whether in that specific case such a partnership effectively exists.

When, for example, a diamond trader X calls upon Y for funding the purchase of diamonds, the first question that arises is whether the financing as provided for by Y for the diamond purchase by X in his own name, can be considered either as a mere financing transaction which should be remunerated with a (variable) interest or whether this funding in fact gives rise to a genuine partnership between X and Y. In the latter case, this will typically result in a so-called “silent partnership” (see also infra). In any case, it is advisable to explicitly document the intention of the parties involved.

The commercial association or temporary trading partnership

This will occur when several persons decide to purchase jointly an expensive diamond or an expensive diamond parcel. Characteristic is that the purchase occurs collectively and the diamond traders subsequently become co-owners (or co-managers or partakers) of the diamond inventory purchased.

This form of collaboration does not have separate legal personality; so all the activities at the level of the partnership are immediately attributed to each and every participant in accordance with his/her share in the partnership. Accounting-wise there will be a propor- tional integration into the books of each partner, again in accordance with his/her share in the partnership.

In addition to the above, tax transparency in principle applies: the turnover realized from the sale of the jointly held diamond stock is recorded by each partner in accordance with the agreed upon net income allocation method, or is at least attributed to each partner for income tax purposes. This is explicitly confirmed in Article 29 of the Belgian Income Tax Code. The part of the (net) profits to which the co-manager is contractually entitled is directly attributed as (taxable) trading profits (or benefits).

In case all partners in the partnership are registered as diamond traders, the Diamond Regime can be applied to the (net) trading profits realized by each partner albeit split between the partners involved in relation to their contribution to the association (i.e. in accordance with the provisions of the partnership agreement).

The silent partnership

In this scenario, a taxpayer participates as a (silent) partner in a partnership where the purchase is executed entirely by the other (managing) partner (or sole manager) in his own name. In such a case, the partnership is typically set-up as a “silent partnership”.

The silent partner provides either goods or financing to the managing partner, i.e. the actual business manager of the partnership. The managing partner subsequently trades entirely in his own name, but also for the account of his silent partner. The above implies that, with regard to the sale of diamonds, only a legal relationship will exist between the managing partner and the third party-purchaser (and, thus, not between the silent partner and the third party-purchaser).

In practice, two approaches are used to record the silent partnership’s transactions for statutory accounting purposes. Either a separate chart of accounts is maintained at the level of the silent partnership itself, and each of the partners (including the silent partner) subsequently integrates his/her proportionate share of the assets and liabilities, income and expenses in his/her own accounts. Alternatively, all transactions of the silent partnership are included in the managing partner’s set of accounts and then, at year-end, the rights of the partners are determined and booked accordingly in the set of accounts of resp. the managing partner and the silent partner(s) (i.e. thus, recording either a receivable or a debt position). In the latter case, reference is again made to Article 29 of the Belgian Income Tax Code. Indeed, the correct tax treatment again implies that the proportionate share of the turnover realized by the managing partner (but also corresponding expenses) must be attributed to the silent partner. The silent partner, therefore, realizes taxable trade income on his/her own behalf.

In the event the silent partner is also a registered diamond trader, the Diamond Regime will also be applicable on his proportional share to the (net) profits (or benefits). The (net) income which is attributed to the silent partner – as a result of the tax transparency principle stemming from Article 29 of the Belgian Income Tax Code – is considered as taxable professional income, and, moreover, qualifies as taxable profit stemming from diamond trading for his own account, which is in itself sufficient for the application of the Diamond Regime.

The silent partner, however, may not be a registered diamond trader (which, strictly speaking, is also not required because, as silent partner, he is in fact not involved at all in the actual trade of diamonds in his own name). Based on the literal wording of the law, in such a case, the taxable income of the silent partner cannot be determined in accordance with the Diamond Regime. After all, since he/she is not officially registered as diamond trader, the Diamond Regime cannot be applied by the silent partner.

Indeed, the tax transparency principle embedded in the aforementioned Article 29 of the Belgian Income Tax Code applies – in our view – only in fiscalibus. Worded differently, the registration of the sole manager as diamond trader will not have any effect in the hands of the silent partner who solely acts as a non-working partner in the silent partnership. Only if the silent partner has a formal registration with the FPS Economy, then the Diamond Regime can (equally) become applicable in his/her hands.

Q7: How is the fixed percentage of the “cost of goods sold” actually applied when determining the net taxable income ?

In the Belgian profit and loss account, the gross margin is determined by deducting the “cost of goods sold” from the gross revenue. For accounting purposes, the cost of goods sold corresponds to the item “trade goods, raw materials and goods for resale”. Pursuant to Article 96, I, A. of the Royal Decree implementing the Belgian accounting legislation, this section consists of various elements, more in particular, the actual purchase price for the goods themselves (first paragraph), the inventory fluctuations (also first paragraph), as well as all additional costs connected to the purchase of the goods (second paragraph).

In this regard, it should be noted that the wording of the law implementing the Diamond Regime specifically refers to a lump sum amount to replace Article 96, I, A., first paragraph of the aforementioned Royal Decree only. This implies that, in practice, the lump sum amount as foreseen in the law, i.e. amounting to 97.9% of the turnover realized, replaces the amount reported under Code 60[1] of the Belgian chart of accounts with regard to the “cost of goods sold”, thus, inventory fluctuations included. Consequently, the additional costs connected to the purchase of the goods are not impacted, since these are listed in Article 96, I, A., second paragraph of the aforementioned Royal Decree.

The Explanatory memorandum to the law of 18 December 2016 clarifies, rightfully so, that the lump sum amount of “97.9% of the turnover realized” only replaces the total amount of resp. subaccounts 600[2], 601[3], 604[4], and 609[5] of the Belgian chart of accounts. The other items of Code 60 of the Belgian chart of accounts (mainly subaccounts 602[6], 603[7], 605[8], 606[9], and 608[10]) are, therefore, excluded from this tax fiction. These costs, when incurred, are subject to the normal rules as foreseen by the Belgian Income Tax Code, e.g. with respect to their tax deductible nature (albeit with the exception of the so-called “processing costs”, see infra).

However, to exclude any effect of stock valuation when determining the taxable result, also any “write-off on stock” expense as stipulated in Section II.E of the Belgian chart of accounts (i.e. subaccount 631) is neutralized for income tax purposes under the Diamond Regime. More in particular, this accounting expense needs to be added to the disallowed items.

This correction (or these corrections) is(/are) only required vis-à-vis turnover realized stemming from diamond trading. If the enterprise also realizes other types of turnover or income, the aforesaid tax corrections do not apply to these other types of turnover or income.

From the above, it is thus clear that the aforementioned diamond inventory difficulties with regard to valuation and monitoring need to be situated within the “cost of goods sold”. It therefore follows that by replacing the “cost of goods sold” for income tax purposes only with a lump sum amount, both types of tax inspection difficulties are resolved in a structural manner.

As a result hereof, the actual cost price of individual trade goods (diamonds) does no longer impact the gross margin (and therefore ultimately the net profits). Simultaneously, this means that going forward there is no need any more for local tax authorities to inspect the diamond inventory valuation and monitoring. Moreover, the impact of stock valuation (higher or lower stock value, resulting in a lower or higher cost of goods sold) is neutralized, which means that inspecting the value of the diamond inventory is no longer required for income tax purposes.

As regards diamond traders/individuals, the previous correction(s) (i.e. the tax fiction) to the tax calculation is/are reflected by a corresponding adjustment to the “net taxable professional income” to be reported for personal income tax purposes. With regard to diamond traders/companies, the net taxable result is adjusted to reflect the lump sum percentage of “cost of goods sold” by either adding a disallowed item if and to the extent that the gross margin for income tax purposes is higher than the gross margin as determined in the annual accounts or, alternatively, by increasing the opening balance of the taxed reserves if and to the extent that the gross margin for income tax purposes is lower than the gross margin as reflected in the annual accounts (see also infra under Q20).

[1] Trade goods, raw materials and auxiliary materials

[2] Purchase of raw materials

[3] Purchase of auxiliary materials

[4] Purchase of trade goods

[5] Stock fluctuations

[6] Purchase of services, work and studies

[7] General subcontracting

[8] Purchase of immovable goods intended for sale

[9] Additional purchase costs

[10] Received discounts, returns of premiums and rebates

Q8: How should the minimum net taxable income of 0.55% (0.65% for tax year 2017) on the turnover realized should be processed ?

With regard to diamond traders/individuals, if and insofar as needed, the amount of the net earned income from diamond trading will be increased to 0.55% of the turnover stemming from qualifying diamond trading.

With regard to diamond traders/companies, in principle a disallowed expense is added to the taxable basis which is equal to the difference between the 0.55% and the net taxable result stemming from the qualifying diamond trade, calculated with the application of the lump sum gross margin of 2.1%.

No such correction is required if and to the extent that this would be the result of a theft or bankruptcy of a client or of the diamond trader himself incurred during the taxable period.

For tax year 2017 only, a slightly increased minimum floor percentage applies, i.e. 0.65% on the turnover realized from qualifying diamond trade.

Q9: What is the impact of the Diamond Regime on the tax deductibility of business expenses, the application of various tax deductions and exemptions ?

The Diamond Regime primarily replaces the actual “cost of goods sold” as reflected the annual accounts with a lump sum amount. More in particular, the “cost of goods sold” which appears in the annual accounts is replaced for income tax purposes only with a fixed amount equal to 97.9% of the turnover realized from diamond trading.

No other adjustments or corrections are made to the Belgian personal income tax regime or the corporate income tax regime following the introduction of the Diamond Regime (e.g. the regime for liquidation reserves continues to apply as well as the so-called “home bonus”, the specific deduction for dependent children, etc.).

Worded differently, a diamond trader can still apply current year notional interest deduction (and, if available, notional interest deduction carried forward from previous taxable periods) under the Diamond Regime.

This being said, it should be noted that in practice a diamond trader/company will only be able to effectively use the notional interest deduction under the Diamond Regime:

- insofar the taxable basis resulting from its diamond trading activities is higher than the “minimum floor”. In such a case, the company will be able to offset its notional interest deduction to the extent the taxable basis does not drop below the “minimum floor” of 0.55% of turnover realized from diamond trading activities (0.65% for tax year 2017).

- insofar the diamond trader/company has a “mixed” activity, the company will be able to deduct the remaining amount of notional interest deduction (if any) from the (net) profits realized stemming from “other” (i.e. non-diamond trading) activities.

For completeness’ sake, we draw your attention to the fact that in case of “mixed” activities the notional interest deduction should reasonably be split on a pro-rata basis between the two types of business activities (i.e. diamond trading vs. non-diamond trading) in relation to the turnover / the (gross) income realized from both activities. However, as previously indicated, this deduction may not result in a net taxable basis for the diamond trading activity which is lower than 0.55% of the turnover realized stemming from these diamond trading activities (0.65% for tax year 2017).

If a diamond trader/company with “mixed” activities has tax losses carried forward and/or notional interest deduction carried forward, we are of the opinion that the taxpayer can freely allocate these available tax attributes during subsequent taxable periods. Worded differently, as far as ‘old’ tax attributes are concerned, it seems that there is no legal obligation to apply a similar split on a pro-rata basis (i.e. between diamond trading and non-diamond trading activities). In this regard, we reiterate however that the application of the Diamond Regime means that the taxable basis with regard to diamond trading can never drop below the 0.55% on turnover (0.65% for tax year 2017).

Nevertheless, in case a diamond trader/company with “mixed” activities incurs losses from its non-diamond trading activities (e.g. immovable leasing) and/or contemplates utilizing current year notional interest deduction after the Diamond Regime has entered into force, we deem it advisable – from a prudence perspective – to offset the tax losses only against (future) income stemming from the immovable lease activity c.q. to split the current year notional interest deduction on a pro-rata basis in relation to the turnover realized by the respective business activities (i.c. comparable to the tax treatment of non-specific costs) (see also infra under Q10).

Q10: How is the notional interest deduction attributed over different types of acti¬vi¬ties, thus, in the event of so-called “mixed” activities (i.e. diamond trading activities com¬bined with other non-diamond trading business activities) ?

The question whether and to what extent the notional interest deduction should be attributed (or split) in the event of “mixed” activities has not been explicitly dealt with in the law, nor in the parliamentary preparatory works. Considering the kind of question, it seems logical to split the notional interest deduction claim over the different business activities. After all, the equity that serves as calculation basis for notional interest deduction purposes in fact guarantees all business operations (and not only the diamond trading activities).

Similarly, the text of the law of 10 August 2015 (which was subsequently changed) prescribed the split of so-called “non-specific costs” in relation to the turnover realized by the respective types of business activities: “If a specific allocation of expenses as referred to in the first paragraph is not feasible, the amount of the expenses that are not specifically linked to other business activities is split on a lump sum basis, i.e. in relation to resp. the turnover stemming from diamond trading and the gross income resulting from the other business activities.”

Given the aforesaid, it seems reasonable that the notional interest deduction claim should also be split in a similar manner, i.e. in relation to resp. the turnover / the (gross) income realized by both types of business activities. With regard to diamond trading, it is reiterated that this specific tax deduction may not lead to a net taxable result which is less than 0.55% on turnover (0.65% for tax year 2017). The aforementioned position has recently been confirmed by the Belgian Minister of Finance in his reply to the parliamentary question nr. 17013 of Mr. Van de Velde.

If, however, the taxpayer can sufficiently demonstrate that a.o. an increase in equity was specifically required, and implemented accordingly, to facilitate a business activity other than diamond trading, it appears equally justifiable that (part of) the notional interest deduction claim would be solely attributed to this other business activity.

Q11: Why are the costs entailed in processing diamonds not deductible ?

The lump sum gross margin of 2.1% reflects a representative and reasonable margin for the mere diamond trading activity, i.e. the purchase of rough diamonds followed by the sale of rough diamonds for its own account, as well as the purchase of polished diamonds followed by the sale of polished diamonds for its own account.

If rough diamonds are purchased and, subsequently, these are processed and sold as polished diamonds, as a rule, this would lead to higher gross margins related to the processing costs incurred.

The Diamond Regime treats this situation equally with the situation of a mere diamond trader (i.e. who is trading in purchased diamonds without further processing) by, on the one hand, applying a similar lump sum percentage of gross margin but, on the other hand, by disallowing the tax deductibility of all diamond processing expenses. In other words, the higher gross margin is not taken into account for income tax purposes, albeit that at the same time the processing costs incurred are also neutralized in fiscalibus.

The aforesaid non-deductible expenses both relate to the costs incurred when processing one’s own diamonds in-house as well as the costs incurred when diamonds are processed by third party-service providers. It goes without saying that a third party diamond manufacturer who, himself, realizes no turnover stemming from diamond trading will not be subject to the Diamond Regime.

With the purpose of providing clarity and legal certainty, all diamond processing costs that should be considered as non-deductible for income tax purposes are explicitly listed in the law. The following costs connected to the processing (either in-house or by through a third party-service) of rough diamonds that are traded by a diamond trader in his own name and for his own account are, therefore, not deductible:

- Polishers’ wages;

- Cleavers’ wages;

- Cutters’ wages;

- Cost of chemicals;

- Cost of grinding discs;

- Cost of mill rental;

- Depreciation of machines for diamond cutting;

- Interests paid on loans specifically entered into to finance machines for diamond cutting;

- Gross employees’ wages, excluding the wages of sorters;

- Costs incurred or borne by the owner of the diamonds for the processing by third party-service providers of rough diamonds purchased by said diamond trader to produce polished diamonds.

If a diamond manufacturer performs its processing activities for third party-diamond traders on the one hand (for which he will be taxed on the actual net income realized for these type of services) and at the same time processes and trades rough diamonds in his own name and for his own account, he will be obliged to make a lump sum split-up of the total processing costs incurred, i.e. in relation to the number of carats produced from polished diamonds.

Q12: How is the turnover from qualifying diamond trading determined ?

As a rule, the turnover realized from diamond trading is the sum of the total diamond sales amount as indicated on all the sales invoices for the taxable period.

For diamond traders/companies, the amount of turnover is reported in the P&L section I.A. “Turnover” (i.e. account 70) of the Belgian chart of accounts.

Where diamond traders/individuals are concerned, all sales invoices should be added up.

In principle, the periodical VAT returns should also reflect the amount of turnover realized.

If sales transactions would occur between related parties, it goes without saying that these transactions should occur at arm’s length conditions (i.e. applying market prices). If e.g. a sale would occur between related parties below market value, then the sales price and, thus, the turnover connected hereto can be subject to a so-called “upward adjustment” for income tax purposes (i.e. transfer pricing correction).

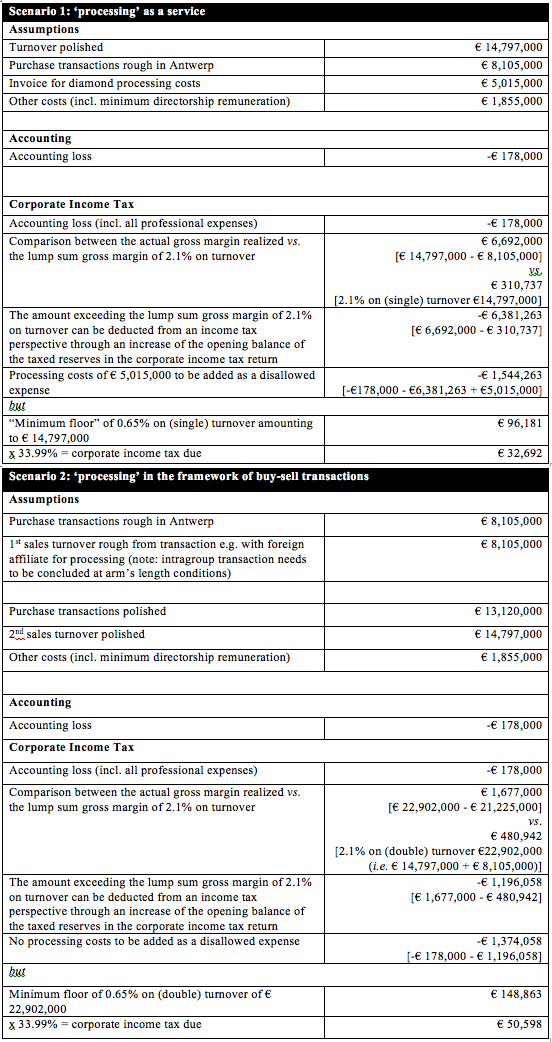

Q13: If a diamond trader/company would purchase rough diamonds in Antwerp and send these abroad (based on a so-called “processing contract”) to be processed and/or polished, what impact would this have on the application of the Diamond Regime ?

A “processing contract” is, usually, a service agreement in nature. Consequently, the shipment of rough diamonds abroad cannot be recorded in the diamond trader’s annual accounts as a sale (/export) or the receipt of the polished diamonds as a purchase (/import). In other words, no separate turnover or margin should be realized on this transaction; it merely concerns processing expenses paid to a foreign service provider, which is not tax deductible in line with the Diamond Regime.

In the rather exceptional case where the aforementioned shipment/receipt is, nonetheless, reflected for both legal and accounting law purposes as a sale & re-purchase transaction, this would have a totally different effect. After all, each transaction entered into the Belgian annual accounts as a sales transaction increases the turnover and is taken into account as such. In the case in hand, revenue is realized twice, whereby the gross margin is determined twice and, therefore, the fixed 2.1% gross margin is applied twice. This diamond trader will however not suffer any adverse tax effect from non-deductible processing costs, as he did not convert the rough diamonds into polished diamonds himself. For income tax purposes the diamond trader has simply purchased rough diamonds and, subsequently, sold them and later bought (back) polished diamonds and sold these.

Ultimately, between the initial purchase of rough diamonds and the ultimate sale of polished diamonds, he realizes a margin, albeit including processing costs. This is expressed by the fixed 2.1% margin on the doubled turnover.

A “processing contract” is typically a service agreement in nature. Consequently, the shipment of the rough diamonds abroad should not be recorded in the diamond trader’s annual accounts as a sale (/export) c.q. the receipt of the polished diamonds as a purchase (/import). In other words, no separate turnover or margin should be realized on this transaction; it merely concerns processing expenses paid to a foreign service provider, which is to be treated as non-deductible in line with the Diamond Regime.

In the rather exceptional case where the aforementioned shipment/receipt is, nonetheless, reflected for both legal and accounting law purposes as a buy-sell transaction for its own account, this would have a totally different effect. Indeed, if such a transaction is effectively recorded in the Belgian annual accounts as a separate sales transaction, it will increase the amount of turnover realized and, hence, it will be taken into account as such. In the case in hand, revenue will be realized twice, as a result of which a gross margin will be determined twice and, therefore, also the lump sum 2.1% gross margin as set forth by the Diamond Regime will de facto be applied twice.

Said diamond trader will however not incur any non-deductible processing costs, since he did not process the rough diamonds into polished diamonds himself. Indeed, for income tax purposes, the diamond trader has simply purchased rough diamonds and, subsequently, sold these and at a later stage bought (back) polished diamonds and sold these (a second time). In the end, considering the initial purchase of rough diamonds and the ultimate sale of polished diamonds, the diamond trader will have realized a margin, albeit including (deductible) processing costs. This is expressed by the application of the lump sum 2.1% gross margin on the doubled turnover.

The aforementioned principles are illustrated through the hypothetical examples hereafter (see infra).

For completeness sake, it should be noted that the above has to be processed in accordance with the applicable accounting rules. Furthermore, one should also pay sufficient attention to any further documentation requirements and/or the defensibility of the applied transfer pricing policy in every specific case.

Q14: Are consignment transfers (consignment out) added to the turnover ?

In principle, such consignments are not added to the turnover as they are not recorded in the P&L Section I.A., first paragraph which refers to respectively:

- the amount of the sale of goods (after all, consignments are not actual “sales”).

- within the context of ordinary business operations;

- after deduction of discounts.

Consequently, consignments outstanding at the end of the financial year should not be considered as “sold” (i.e. different from the tax treatment under the so-called “Fiscal Plan”). These specific transactions are, therefore, no longer included in the turnover realized which in itself forms the starting point for the tax calculation under the Diamond Regime.

Q15: What if the turnover is expressed in USD rather than in EUR ?

In that case, pursuant to Article 70, paragraph 3 of the law of August 10, 2015, the turnover must be converted based on the average exchange rate for the relevant taxable period (i.e. the applicable average exchange rate will be published by the Belgian tax authorities).

Considering the clear provision as stipulated in the law, there is no possibility to apply e.g. the exchange rate at the end of the taxable year (or any other exchange rate for that matter, except for the indicated average rate).

For completeness sake, it should be noted that the issue of foreign currency exchange rate differences, which should be recorded separately in the financial results in accordance with Belgian accounting law (i.e. in P&L-accounts 654 or 754, depending on the case), is a completely separate issue from the specific inventory valuation and monitoring difficulties related to diamond trading.

Worded differently, the normal rules in terms of both taxability as well as tax deductibility remain therefore fully applicable insofar as these are effectively recorded in the diamond traders’ Belgian annual accounts.

Q16: Are currency exchange rate differences related to the purchase and sale of diamonds still deductible / taxable ?

Yes. In this respect, we also refer to our comments under Q17.

Q17: What is the exact scope of the exclusion as regards so-called transfer pricing adjustments (cf. Articles 26, 79, 207, and 185, paragraph 2 of the Belgian Income Tax Code) ?

In this regard, a specific reference was made in the Explanatory memorandum: “This approach (…) still means that, more precisely, which is defined in Articles 26, 79, 185 and 207 of the Belgian Income Tax Code 1992, still has no relevance as to the amount of the cost of goods sold”.

Under the Diamond Regime, the application of a lump sum gross margin for income tax purposes only means that whether the trade goods were bought too expensively or too cheaply from a related party is not directly relevant, at least not for Belgian income tax purposes. This however does not mean that the trade in diamonds should not take place under market conditions. On the contrary, the arm’s length principle still applies e.g. in order to be able to justify the arm’s length nature of the purchase / sales transaction abroad vis-à-vis the local tax authorities. Furthermore, any sales transaction from Belgium must also meet the arm’s length yardstick, if not, the Belgian tax authorities can adjust the taxable basis in accordance with the Articles 79, 207, and 185, paragraph 2 of the Belgian Income Tax Code. Finally, it should be noted that, assuming all conditions are met, the Diamond Regime does not have any impact on the recently introduced Belgian transfer pricing documentation obligation that also applies to diamond traders/companies.

Finally, the aforementioned specific anti-abuse rules for transfer pricing purposes as cited in the Belgian Income Tax Code apply in full to other intragroup transactions as well, such as intragroup loans, making intellectual property available within the group and providing supporting services in the areas of HR, management, etc.

Q18: Is the obligation to pay a minimum directorship remuneration still relevant under the new Diamond Regime ?

Yes. The net taxable income from diamond trading as set forth under the Diamond Regime implies that at least one company director receives a minimum directorship remuneration as defined by the law. Since we are discussing the reference remuneration for a company director, the payment of such a minimum remuneration only applies to diamond traders/companies.

For clarity’s sake, it should be noted that this particular requirement is not fulfilled if the minimum directorship remuneration is split and paid to two (or more) different company directors and they, therefore, each individually receive less than the required amount as defined by the law.

Furthermore, it should be noted that the minimum directorship remuneration requirement needs to be assessed per separate legal entity/company. It is therefore irrelevant that the company director/individual receives a total remuneration, e.g. paid by two diamond traders/companies, exceeding the reference amount in relation to the total turnover realized by each diamond trader/company separately (see also infra). Indeed, in such a case each of the diamond traders/companies should pay a minimum directorship remuneration in relation to their own turnover to avoid a correction in this regard under the application of the Diamond Regime.

The concept of “company director” is defined in Article 32 of the Belgian Income Tax Code. In short, this includes the mandated directors as well as those individuals who, as a self-employed professional, take on a managerial role or participate in the diamond trader/company’s day-to-day management.

The aim of this measure is to ensure that the minimum directorship remuneration is effectively borne as expenditure during the relevant financial year. The actual date of payment is irrelevant. Consequently, strictly speaking, it is therefore perfectly feasible to pay a sufficiently high amount as a directorship fee (or “tantièmes” in Dutch) to one or more company directors e.g. upon the formal approval of the company’s statutory accounts. After all, such directorship fee is recorded as a (deductible) business expense in the relevant annual accounts, which have already been closed as well as approved.

Replacing the minimum directorship remuneration with a dividend payment for a similar amount is not acceptable in terms of the Diamond Regime.

On the other hand, it suffices that the company whose financial year coincides with the calendar year to appoint e.g. an additional company director next to the other non-remunerated directors, so that the directorship fee effectively paid to the aforesaid newly appointed director can qualify to comply with the minimum remuneration requirement.

If the director is in fact a professional services company, the above requirement is complied with if the diamond trader/company pays the required minimum directorship remuneration to this professional services company and, subsequently, the professional services company pays on its turn the same minimum amount to the director/individual for whom this amount is subject to the Belgian personal income tax regime (or the Belgian non-resident income tax regime).

This being said, it should be noted that the legal exception that allows the use of a professional services company does not allow the use of a double corporate structure. Indeed, as explicitly foreseen by the law, for the exception to be applicable it is sufficient but necessary that the professional services company that receives the directorship fee from the diamond trader/company on its turn directly pays the (minimum) amount to the director/individual.

In short, the relevant legal provisions clearly state that:

- the use of a cascade of professional services companies is not permitted. Worded differently, the look-through rule only applies to one legal entity level;

- it is required that the (ultimate) director/individual (i.e. the permanent representative of the professional services company) is effectively subject to either the Belgian personal income tax regime or the Belgian non-resident income tax regime.

The amount of the minimum directorship remuneration varies in accordance with the turnover in the same way as under the so-called “Fiscal Plan”. The applicable amounts were however indexed for the period between the year 2000 and today.

For completeness sake, it is mentioned that the table below refers to the gross amounts before income tax. Any taxable benefits in kind also constitute part of the directorship remuneration package.

The reference amounts as foreseen in the law before indexation are as follows:

- 19,645 EUR for a turnover up to 1,620,720 EUR;

- 32,745 EUR for a turnover between 1,620,720 EUR and 8,103,595 EUR;

- 49,110 EUR for a turnover between 8,103,595 EUR and 16,207,190 EUR;

- 65,485 EUR for a turnover between 16,207,190 EUR and 32,414,380 EUR;

- 81,855 EUR for a turnover between 32,414,380 EUR and 48,621,570 EUR;

- 98,225 EUR for a turnover of more than 48,621,570 EUR.

For tax year 2017, this leads to the following indexed amounts:

- 30,170 EUR for a turnover up to 2,488,780 EUR;

- 50,280 EUR for a turnover between 2,488,780 EUR and 12,443,880 EUR;

- 75,410 EUR for a turnover between 12,443,880 EUR and 24,887,760 EUR;

- 100,560 EUR for a turnover between 24,887,760 EUR and 49,775,520 EUR;

- 125,700 EUR for a turnover between 49,775,520 EUR and 74,663,280 EUR;

- 150,830 EUR for a turnover of more than 74,663,280 EUR.

For tax year 2020, this leads to the following indexed amounts:

- 32,060 EUR for a turnover up to 2,645,180 EUR;

- 53,440 EUR for a turnover between 2,645,180 EUR and 13,225,880 EUR;

- 80,150 EUR for a turnover between 13,225,880 EUR and 26,451,750 EUR;

- 106,880 EUR for a turnover between 26,451,750 EUR and 52,903,510 EUR;

- 133,600 EUR for a turnover between 52,903,510 EUR and 79,355,260 EUR;

- 160,310 EUR for a turnover of more than 79,355,260 EUR.

The net taxable income calculated taking into account the lump sum gross margin as defined under the Diamond Regime must be increased with each deficit in the minimum directorship remuneration paid (i.e. with or without application of the “minimum floor”-clause). Indeed, also the application of the “minimum floor”-clause – as a result of which the minimum net taxable income is determined at 0.55% (0.65% for tax year 2017) of the turnover realized –assumes the payment of the minimum directorship remuneration and, therefore, any deficit vis-à-vis the applicable reference amount should be added to the 0.55% (0.65% for tax year 2017) on turnover.

Any deficit in terms of the minimum directorship remuneration is in principle added as a disallowed item in the diamond trader/company’s corporate income tax return. As already indicated, every deficit will in any case constitute a minimal taxable basis for the diamond trader/company concerned. Worded differently, the diamond trader/company is not allowed to use any of its available tax attributes or e.g. current year losses to reduce the effective tax burden in connection hereto.

Furthermore, it should be noted that, strictly speaking, the legal provisions of the law do not explicitly foresee in any specific rule in the event that the diamond trading activities are only carried out during a limited period in time during the taxable period. Worde differently, the Diamond Regime does not provide for any pro-rata approach as regards the minimum directorship remuneration condition. The aforementioned viewpoint has recently been confirmed by the Belgian Minister of Finance in reply to the parliamentary question nr. 17013 of Mr. Van de Velde.

If a diamond trader/company carries out “mixed” activities, it is reasonable to also split the directorship remuneration paid between the different types of business activity. The fact that such an allocation (split) would occur in relation to the turnover / the (gross) income realized by the resp. business activities seems most likely, although other allocation keys might in principle also be applicable if these would lead to a more fair and true view.

For sake of completeness, it should be noted that the minimum directorship remuneration requirement is applicable irrespective of the fact that the diamond trader/company would in casu conduct mixed business activities (i.e. diamond trading vs. non-diamond trading). Based on the above, it is clear that when one would assess this specific requirement as foreseen by the Diamond Regime (i.e. in case of “mixed” activities) reference should only be made to that part of the directorship remuneration that is allocated to the company’s diamond trading activity.

Finally, in terms of tax deductibility, the Diamond Regime has not introduced any specific rule. Consequently, the general principles regarding the tax deductibility of business expenses, etc., as foreseen in the Belgian Income tax Code fully remain applicable to diamond traders.

Q19: A registered diamond trader does not generate any turnover during a given financial year. He does not trade any diamonds during that financial year. Is the diamond trader/company obliged to pay the minimum directorship remuneration in such a case ?

In this regard, the law explicitly states that: “With regard to the determination of the taxable result of a company or a Belgian permanent establishment, the amount of the net taxable income is determined by applying of this article, potentially increased with, where appropriate, the positive difference between the minimum reference remuneration as defined for a company director in this paragraph and the highest directorship remuneration borne by the company or the Belgian permanent establishment during the taxable period.”

Consequently, it can be argued that the application of this legal provision assumes that the net taxable income is also determined with the application of this article and, therefore, the application of the Diamond Regime. The law subsequently states: “Said reference remuneration is determined based on the turnover realized from diamond trading and amounts to: (…)”

Considering the above, it can thus be concluded that if no turnover is realized from diamond trading then, strictly speaking, no lump sum gross margin is determined and no “taxable income” is determined with the application of the Diamond Regime. This viewpoint has recently been confirmed by the Belgian Minister of Finance in reply to the parliamentary question nr. 17013 of Mr. Van de Velde.

Q20: Practically speaking, how does one prepare a Belgian corporate income tax return while applying the Diamond Regime ?

For starters, you compute the increase in the diamond trader/company’s (taxed) reserves, the (regular) disallowed items as well as the distributed dividends (if any).

Subsequently, you report an “increase in the opening balance of the (taxed) reserves” if and to the extent the actual gross margin as reflected in the annual accounts is higher than the lump sum gross margin. As a result hereof, any difference is effectively neutralized for income tax purposes. If, alternatively, the actual gross margin realized is lower than the lump sum gross margin, an additional “disallowed item” should be included in the corporate income tax return.

Any non-deductible processing costs also need to be added to the taxable result by means of an (additional) disallowed item.

In a next step, one should assess whether the final net taxable income following the above effectively equals or exceeds the “minimum floor” amounting to 0.55% on turnover. If not, another disallowed item needs to be added equal to the amount of this deficit[1].

Finally, one needs to verify whether the diamond trader/company has correctly paid out the minimum directorship remuneration. If there is a deficit in this regard, then this difference also needs to be added to the disallowed expenses[2].

As far as the “special” disallowed items are concerned, i.e. any shortage vis-à-vis the “minimum floor”-clause as well as any shortfall in terms of the minimum directorship remuneration, we reiterate that these disallowed items cannot be offset with any tax attributes available or e.g. with any current year loss. Worded differently, both “special” disallowed items will constitute in any case a minimal taxable basis for the diamond trader/company. In this regard, we can also refer to our comments under Q9, Q10 and Q18.

For completeness sake, please note that the so-called “dividend received deduction” regime can never be used to lower the taxable result from diamond trading. Indeed, this specific tax deduction is inherently linked to another business activity within the company, namely the “holding”-function. In other words, a detailed breakdown should be made each year to filter any “other” income vs. income from diamond trading (i.e. hereby leveraging on the taxpayer’s divisional accounting charts).

[1] Cf. the systematics as foreseen in the income tax return form for tax year 2017.

[2] Idem.

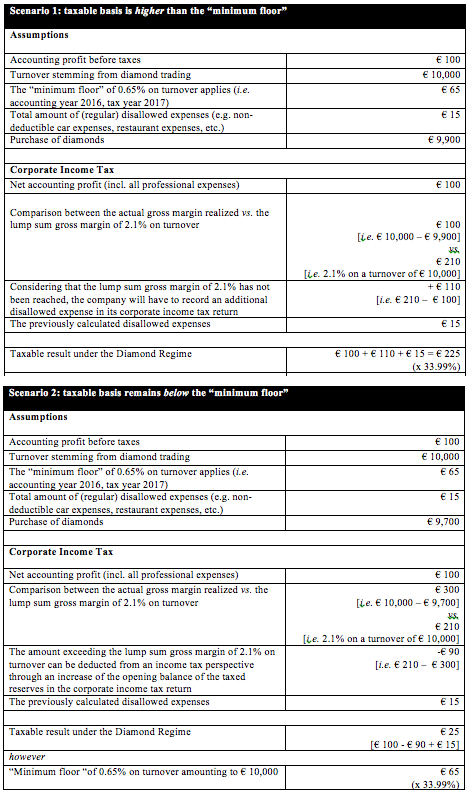

Q21: What is the impact of the (regular) disallowed expenses on the minimal taxable basis from the perspective of a diamond trader/company (without conducting “mixed” activities) ?

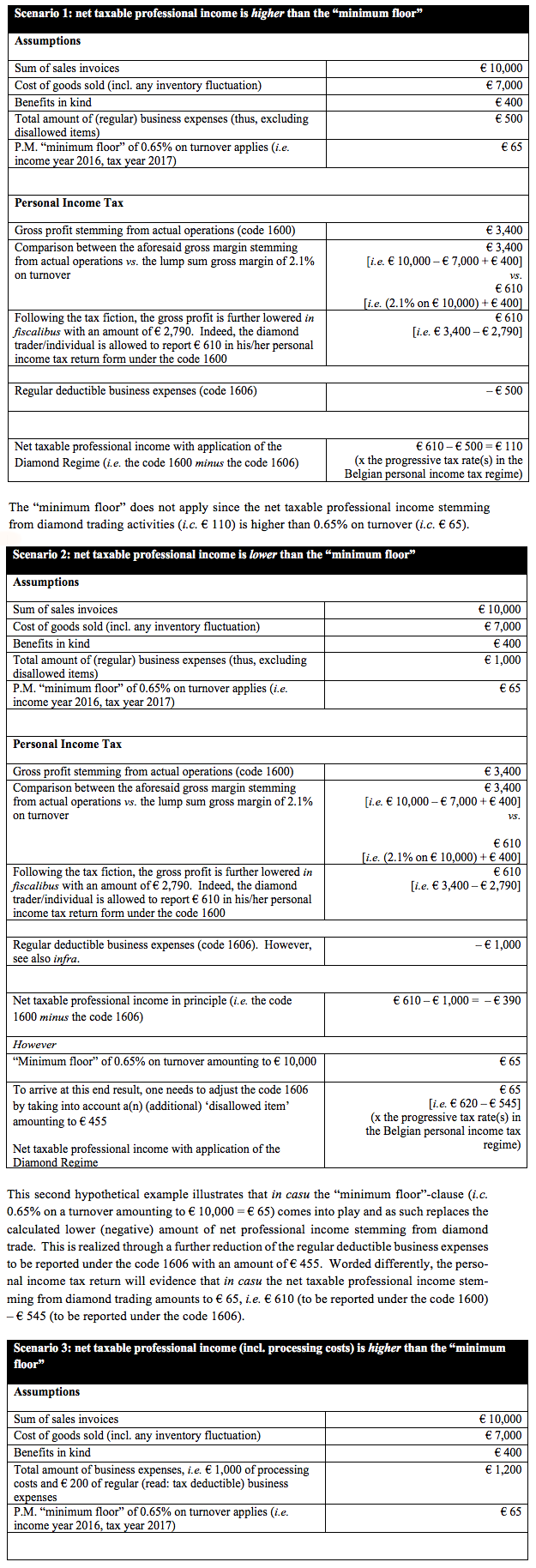

As illustrated hereafter by the hypothetical examples, the answer to this question depends in essence on the amount of the diamond trader/company’s final taxable basis. Indeed, if the taxable basis is higher than the “minimum floor” of 0.55% on turnover (0.65% for tax year 2017), then the disallowed expenses will have a ‘push up’ effect. If, alternatively, the taxable basis remains below this “minimum floor”, then the disallowed expenses will not have such an effect on the taxable basis.

The “minimum floor” does not apply since the net taxable result from diamond trading activities (i.e. € 225) is higher than 0.65% on turnover (i.e. € 65). Nevertheless, based on this first hypothetical example, it can be ascertained that the (regular) disallowed items clearly have an impact on the taxable basis, in the sense that they have a ‘push up’ effect.

The second hypothetical example illustrates that an increase of the disallowed items (+ € 15) does not affect the final outcome because the “minimum floor”-clause (i.c. 0,65% on a turnover amounting to € 10.000 = € 65) comes into play and as such replaces the previously calculated (lower) taxable basis. From an income tax return filing perspective, this can be achieved by adding an additional disallowed expense amounting to + € 40 (i.e. € 65 – € 25). In this second scenario, the diamond trader/company will be taxed on € 65 (x 33.99%).

Q22: What is the impact of the new Diamond Regime if a diamond trader has revalued his/her diamond inventory, by applying the special law of 2006 ?

To safeguard the tax exemption as provided for by the 2006 special law, a so-called intangibility condition needed to be complied with up and until the end of the 2016 financial year. The Diamond Regime did not have any impact whatsoever on the 2006 special law. If the diamond trader would no longer respect the aforesaid intangibility condition, then an additional tax will become due. Worded differently, the aforementioned tax exemption will be considered as final as of the start of financial year 2017.

Q23: Why has the concept of “genuine and habitual” diamond trading been introduced into the law ?

The concept serves an anti-abuse objective, namely to protect against any artificial diamond trading, such as money laundering by so-called “pseudo” diamond traders organized as a start-up, to prevent the tax fictions of the Diamond Regime to apply (e.g. realizing a substantial net profit resulting from diamond trading activities that have only just been started and that will only be carried out briefly). Clearly, the Diamond Regime can only apply to sincere, bonafide diamond traders.

The Diamond Regime is not applicable to income from “non-genuine” and “non-habitual” diamond trading. Such income is subject to the standard Belgian income tax regime. The burden of proof in this respect, in what should be very exceptional cases, lies with the Belgian tax authorities.

The Explanatory memorandum to the law includes a non-exhaustive list of various key indicators that will be taken into account to demonstrate that diamond trading activities can potentially be considered not to be “genuine and habitual”.

Q24: Which elements are to be taken into account to determine the “non-genuine” or “non-habitual” nature of diamond trading activities ?

Please note that the list below needs to be considered as non-exhaustive, which means that other elements may also be taken into consideration. None of the following elements in itself is a determining factor as such; these elements serve as indications of diamond trading transactions that could potentially be considered as not “genuine and habitual”.

The key indicators mentioned hereafter are merely elements that could be considered relevant when assessing a specific case.

In any event, the burden of proof for demonstrating that a diamond trading transaction is not genuine and habitual, lies with the Belgian tax authorities:

- Trade transactions by a non-bourse member;

- Trade transactions involving unusual diamond trading centres;

- Financing through banks that are not generally known to be active in or focused on diamond trading industry or have certain specific experience in the diamond trade;

- Diamond traders not complying with the strict requirements of diamond inventory declaration, anti-money laundering (i.e. customer identification), etc.;

- Recently started diamond enterprises realizing already large revenues, with or without significant margins, albeit without a reasonable explanation hereto;

- Realizing clearly excessive margins given the nature of the goods and the trade transaction, especially if these are realized by diamond traders without a “track record” in the market.

Q25: What proof of bankruptcy is to be submitted by the taxpayer to demonstrate the bankruptcy of a foreign debtor ?

In principle, relevant proof must be submitted by the taxpayer of a comparable foreign debt settlement with e.g. the intervention of the government, a court, etc. The final confirmation of the definite loss generally implies the intervention of a third party.

The Belgian tax authorities make no distinction between a domestic and a foreign bankruptcy case. As a rule, the Belgian tax authorities require firm evidence of the formal closure of the liquidation / bankruptcy. In practice, e.g. upon the occasion of a tax audit, they are generally speaking more flexible in accepting underlying evidence. A formal declaration, e.g. from the company liquidator in which he indisputably states that (part of) the claim is to be considered definitively irrecoverable, often suffices.

The tax courts generally adhere to an even more flexible interpretation, in which, in such a case, it may be demonstrated by any means of law that (part of) the claim is definitively and irrevocably lost, e.g. by means of various correspondence with the debtor himself, the competent liquidators, the attorneys involved, etc.

Q26: Can the Diamond Regime be applied to the specific case of “securitisation” ?

In practice, it occurs that a diamond trader purchases goods and subsequently concludes a so-called “securitization”-transaction as a (re)financing technique with respect to the purchased diamond inventory. A securitisation transaction typically requires a so-called “true sale” from a legal perspective, which means that the legal ownership effectively transfers from the diamond trader to the securitisation vehicle (i.e. a “special purpose vehicle” or “SPV”).

The securitisation vehicle is most often a separate legal entity with the sole purpose to act as intermediary (hence, the notion of a “special purpose vehicle” or “SPV”) between the so-called “originator” (i.e. the diamond trader) and certain investors and/or financiers. Indeed, said securitisation vehicle or SPV has a double function: it purchases the assets in full ownership from the originator and, simultaneously, it (re)finances this purchase transaction by means of the issuance of securities.

In this regard, it should be noted that the acquired assets are considered as collateral with respect to the issued securities. Indeed, it is the clear intention to provide the investors with a specific security as regards the securitised assets, i.e. separate from the general credit risk vis-à-vis the (diamond trading) enterprise that decided to refinance through a securitisation transaction. Consequently, it can be concluded that the legal ownership of the diamond inventory is effectively transferred, albeit not as a result of a commercial transaction, but merely as a “security arrangement” for the investors involved.

In this context, the Explanatory memorandum explicitly mentions that through such a transfer of legal ownership, no actual “turnover stemming from diamond trading” is being realized. More in particular, the Explanatory memorandum states that “turnover stemming from diamond trading does not include the sales price realized in case an enterprise is conducting diamond inventory (re)financing and diamond inventory risk management through the technique of diamond inventory securitisation. In such a case, the sales price is paid by a (re)financing vehicle which in itself is not active in any way in the diamond trade and therefore the sales price received cannot be considered as turnover stemming from diamond trading” (cf. Parl. Documents, Belgian Chamber of Representatives, Doc. 54, 1125/001, p. 76).

Given the above, it can be argued that in such a case the transfer of legal title does not relate to a “habitual” diamond trade and as such does not result in turnover subject to the Diamond Regime. In other words, the securitisation transaction does not lead to a “double” turnover (i.e. once upon the moment the securitisation transaction occurs and a second time upon the moment the diamond trader/company sells the diamond inventory to a third party/purchaser), nor does it lead to a “double” cost of goods sold (i.e. once upon the moment the diamond trader/company actually purchases the goods on the market and a second time upon the moment the diamond trader/company repurchases the goods from the securitisation vehicle).

This being said, it should be noted that the Diamond Regime will in principle be applicable to the diamond trader who repurchases the securitised diamond inventory and, subsequently, resells this inventory on the market for its own account. In any case, one should only proceed with sufficient caution as regards the correct accounting treatment of the aforesaid (securitisation) transaction(s).

Q27: Do modifications to the closing date of the financial year after 30 March 2015 have any impact on the application of the Diamond Regime ?

The Diamond Regime is applicable as from tax year 2017 onwards. If a diamond trader/company’s closing date of the financial year coincides with the calendar year (i.e. on 31 December 2016), then as a matter of principle the rules of tax year 2017 will typically apply. However, at the same time, it should be noted that the law introducing the Diamond Regime explicitly mentioned that any modification to the financial year as from 30 March 2015 onwards would not trigger any effect as regards the entry into force of the Diamond Regime.

The aforesaid can be further explained through a practical example: the financial year of a diamond trader/company originally ran from 1 October 2015 up and until 30 September 2016. In the course of 2016, however, the taxpayer changed the closing date of its financial year. More in particular, the financial year was extended with three months, i.e. up until 31 December 2016. As a result hereof, the rules as regards tax year 2017 would principally apply in the case at hand. However, based on the above, the question does arises whether and to what extent the Diamond Regime can effectively be applied to the (extended) financial year from 1 October 2015 up and until 31 December 2016.

Based on a general reading of the law, it seems that the Diamond Regime can in principle not be applied by the taxpayer vis-à-vis its (extended) financial year ended per 31 December 2016. However, upon a literal interpretation of the legal provisions, it can be reasonably argued that the financial year needs to be split up in resp. the period up until 30 September 2016 during which the Diamond Regime cannot be claimed and a second period as from 1 October 2016 up and until 31 December 2016 during which the law can be applied. It goes without saying that such segmentation of the financial year should also be duly documented for statutory accounting purposes.

Q28: How should the set-up of accruals for risks and charges and the potential reversal hereof be treated under the Diamond Regime ?

In essence, the Diamond Regime replaces the actual “cost of goods sold” realized by a lump sum percentage of 97.9% of turnover. In addition, the regime requires that the net taxable income of a diamond trader equals 0.55% (0.65% for tax year 2017) of turnover. Finally, the diamond trader/company should pay a minimum directorship remuneration in relation to the level of turnover realized.

Given the above, it can be concluded that the Diamond Regime remains silent as regards the set-up and potential reversal of accruals for risks and charges. In short, accruals are recorded as a cost for accounting purposes and can be treated as tax deductible if and to the extent that the legal conditions as set forth by Article 48 of the Belgian Income Tax Code are fulfilled simultaneously. This equally implies that the reversal of a tax deductible accrual at a later stage is neutrally for income tax purposes (equally so under the application of the Diamond Regime). It is self-evident that the set-up of an accrual for risks and charges can trigger the application of the “minimum floor”-clause even faster.

When specifically focusing on so-called “provisions for doubtful debtors” more caution seems appropriate. Indeed, this type of accruals can have a ‘perverse’ effect on the (non-) application of the “minimum floor”-clause in case a bankruptcy would effectively occur at a later stage.

The law specifically stipulates that the “minimum floor”-clause does not come into play“if the net accounting profit of the taxable period cf. Belgian accounting law is less than 0.55% of the turnover stemming from the diamond trade for reasons of resp. theft, bankruptcy of a client or bankruptcy of the registered diamond trader in question”.

It therefore follows that the “minimum floor”-clause will not apply only in very restrictive cases. Indeed, for the exception (i.e. the non-application of the “minimum floor”-clause) to apply, the following two conditions have to be met simultaneously:

- a theft or bankruptcy has to occur in the relevant year (1st condition);

- as a result of which the accounting profit of the diamond trader falls below the 0.55% (0.65% for tax year 2017) on turnover (2nd condition).

The aforesaid can be further clarified as follows:

- A provision for a doubtful debtor is set-up by a diamond trader in a given financial year (in year x). This accrual can be considered tax deductible to the extent the legal conditions as prescribed by Belgian domestic tax legislation are effectively fulfilled (cf. Article 48 of the Belgian Income Tax Code).

However, given the fact that the bankruptcy of the doubtful debtor concerned has not yet crystalized (1st condition), the legal exception as regards the “minimum floor”-clause does not come into play. Worded differently, if the net taxable income at the end of the taxable period would be negative, the “minimum floor”-clause of 0.55% (0.65% for tax year 2017) would continue to be applicable.

- If, during a later taxable period (in year x+1), the aforesaid doubtful debtor eventually goes bankrupt, the accrual needs to be reversed from an accounting perspective. At the same time, a capital loss on the receivable can be recorded in P&L as a current year (deductible) business expense by the diamond trader. This capital loss will in principle also be treated as tax deductible (in accordance with the tax deductibility requirements as set forth by Article 49 of the Belgian Income Tax Code).

However, the above accounting entries will in principle result in the fact that in year x+1 there is no net accounting impact (anymore) on the diamond trader’s taxable result. Indeed, the reversal of the previously incurred provision (i.e. a credit entry in the P&L in year x+1) is immediately neutralized by the capital loss on the receivable (i.e. a debit entry in the P&L in year x+1).

As a consequence, the capital loss on the receivable albeit incurred in year x+1 will no longer have any lowering effect on the diamond trader’s accounting profit. Worded differently, said capital loss cannot result in the accounting profit in year x+1 to fall below the 0.55%-threshold (0.65% for tax year 2017). As already indicated, since the capital loss on the receivable does not have any net impact on the accounting profit in year x+1, the diamond trader can neither rely on the legal exception to the application of the “minimum floor”-clause in year x+1.

For the sake of completeness, we would like to point out that – in any case – the bankruptcy of one (or multiple) customer(s) does not result in the dismissal (i.e. non-application) of the Diamond Regime. In accordance with article 70, §6 in fine of the coordinated Law regarding the Diamond Regime, the bankruptcy may at most have an impact on the non-application of the so-called “minimum floor” of 0.55% on the turnover realised from qualifying diamond trade.

More specifically, this provision states that the “minimum floor” may be ‘ignored’ if the following two conditions are simultaneously met:

- the bankruptcy – or theft – should have as a consequence in the concerned year that (1st condition);

- the diamond trader’s profit before tax amounts to less than 0.55% of his realised turnover (2nd condition).

As aforementioned in the existing Q&A, the wording of this provision may lead to an undesirable result, particularly given the ‘mismatch’ between the accounting treatment of the (imminent) bankruptcy on the one hand and e.g. the termination of the bankruptcy procedure on the other, the “minimum floor”- provision may still have to be applied in a particular case.

As clarified during our recent discussion, we believe that this provision can be interpreted in two ways:

- In a ‘strict’ manner: the explanatory memorandum of the initial Law regarding the Diamond Regime (cf. the draft of the Law of 10 August 2015) only mentions the term ‘bankruptcy’. It does not specify whether this term refers to the start, the procedure itself or to the closure of the bankruptcy. This lack of precision may benefit the Belgian tax authorities in applying their traditionally strict approach. Indeed, the tax authorities generally require strict proof of the effective closure of the liquidation/bankruptcy in order to demonstrate that (part of) the receivable has become definitively irrecoverable.

In view of the conditions set out above, the strict interpretation would imply that the non-application of the “minimum floor” could only be successfully invoked if the concerned diamond trader has recorded the definitive loss of his receivable (as a result of the effective closure of the customer’s bankruptcy procedure). In addition, the entry of the definitive loss must result in an accounting profit that is lower than the 0.55%-limit in the same accounting year. In other words, the concerned diamond trader has not yet recorded any provision for doubtful debtors e.g. in the course of the liquidation procedure.

- In a more ‘flexible’ manner: in accordance with Belgian accounting law and the general principles of Belgian corporate income tax, the concerned diamond trader may, e.g. shortly after the start of the liquidation procedure based on the specific facts/elements in the case at hand, set up a provision for doubtful debtors in order to anticipate for the (entire or partial) final cost which – in all probability – will be incurred at the definitive closure of the bankruptcy.

If a provision for doubtful debtors were to result in an accounting profit before tax that is lower than 0.55% on the turnover realised from qualifying diamond trade in that same year, we believe that the non-application of the “minimum floor”-provision could be reasonably defended, despite the fact that the bankruptcy has not yet been finalised.

We believe that good arguments exist in favour of such a ‘flexible’ interpretation. For example article 70, §6 of the coordinated Law on the Diamond Regime does not explicitly mention the definitive closure of the bankruptcy. Nor does the explanatory memorandum of the initial Law or the final Law contain such a specification. In addition, we would like to point out that in tax practice – in line with relevant tax case law – a flexible interpretation has been applied with regard to the burden of proof. In general, it is necessary but sufficient to e.g. obtain a certificate from the liquidator in which it is indisputably stated that (part of the) claim has become definitively irrecoverable.

Q29: How are ‘Other operating income’ (account 74), ‘Financial income’ (account 75) and ‘Non-recurring operating or financial income’ (account 76) treated within the scope of the Diamond Regime ?